2024-01-26

5 min read

SAFEs: A Comprehensive Guide for Startup Founders in 2025

Vandana Singh

Founder and Company Secretary

2024-01-26

5 min read

Vandana Singh

Founder and Company Secretary

“SAFE” stands for Simple Agreement for Future Equity. Safe Note is an instrument/ agreement issued by early start-ups to raise funds in their initial seed stage from Individual angel investors. SAFE is a legal contract that entitles investors to receive a company's equity securities contingent upon certain events such as subsequent rounds of funding.

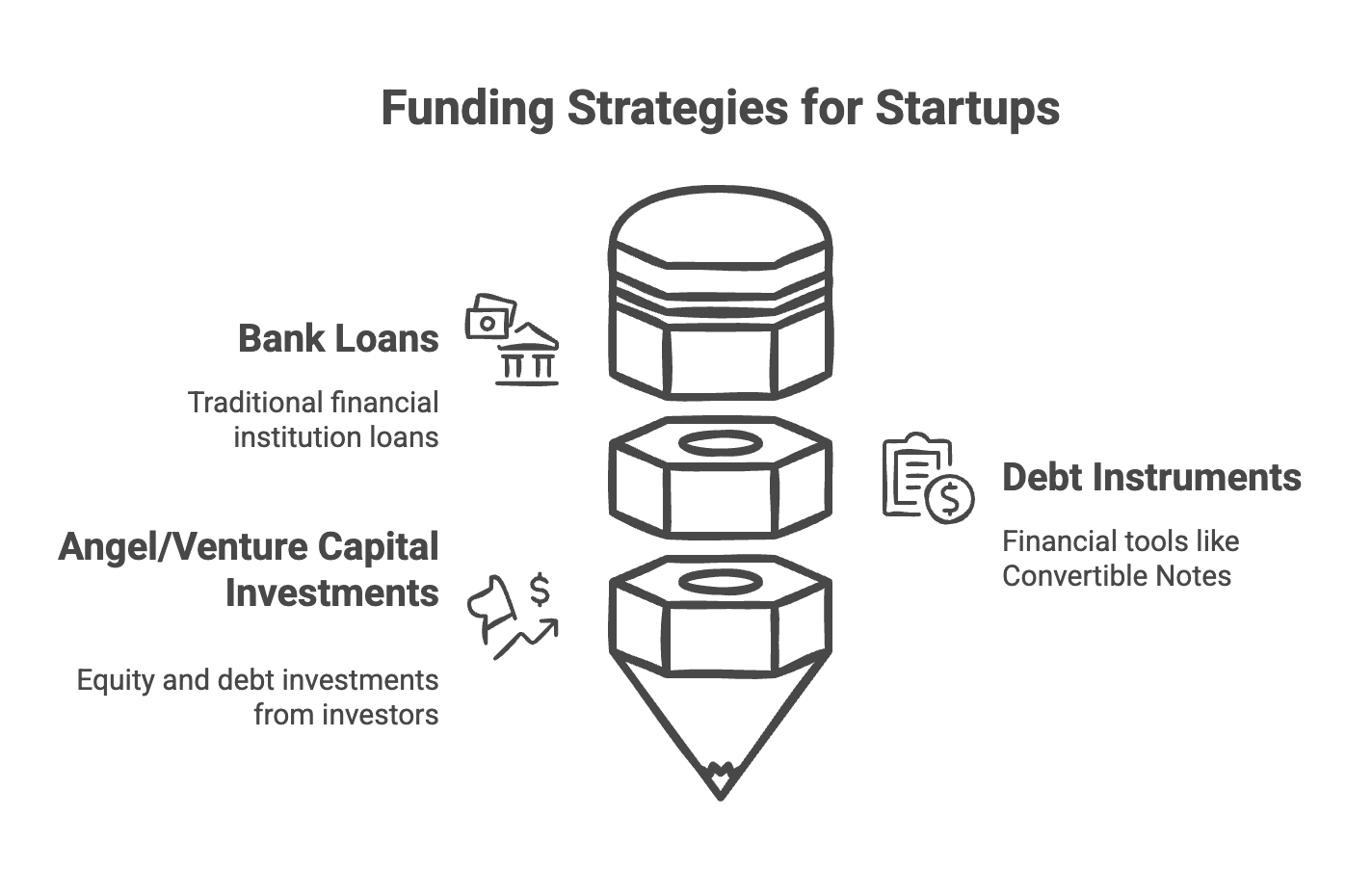

An early-stage start-up Company needs capital to build the idea or the product which is often very challenging. These companies rely on raising funds through:

While CCPS or CCDs/CNs are the most preferred instruments of securities, they have their nuances and challenges. Angel investors are looking out for alternate easy and less time consuming investment routes. One such investment model is Safe Notes.

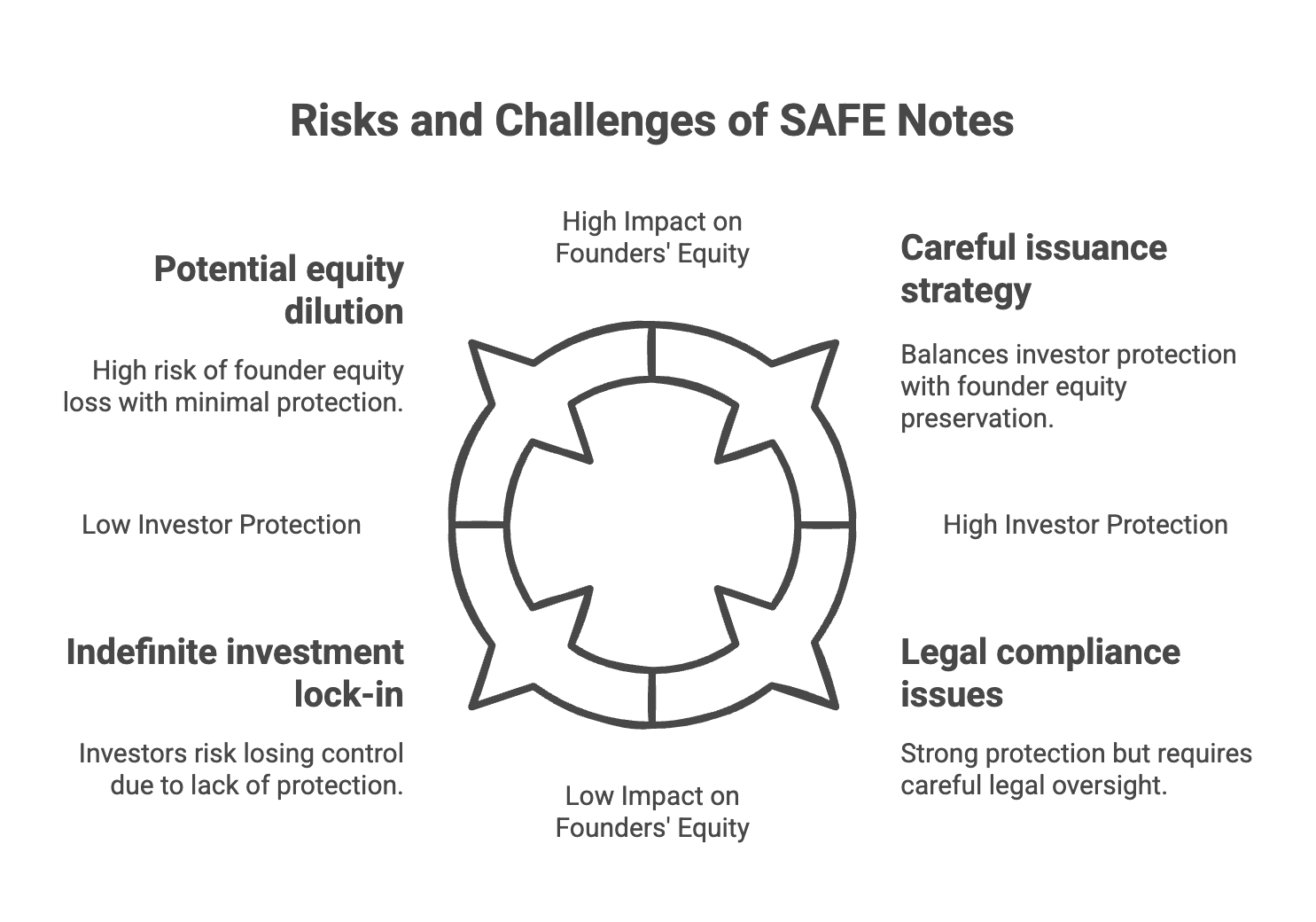

At the early stage of a start-up, it is difficult for the company to project costs/ revenue and assign value to its business. Revenue projections and valuations form an essential requirement for raising funds by way of the issue of securities. The start-up has to undergo the complicated process of due diligence and respond to the information requests of the investor/ their legal team. The founders, the Company, and the investor need to enter into complicated shareholders agreement and negotiate on various terms of agreement which is a time-consuming process. Hence, the founder is unable to focus on the business needs of the start-up, while he is involved in fundraising activities.

Additionally, taking on debt can complicate the start-up life cycle and the start-up may collapse due to financial pressure to adhere to deadlines and pay back loans and interest.

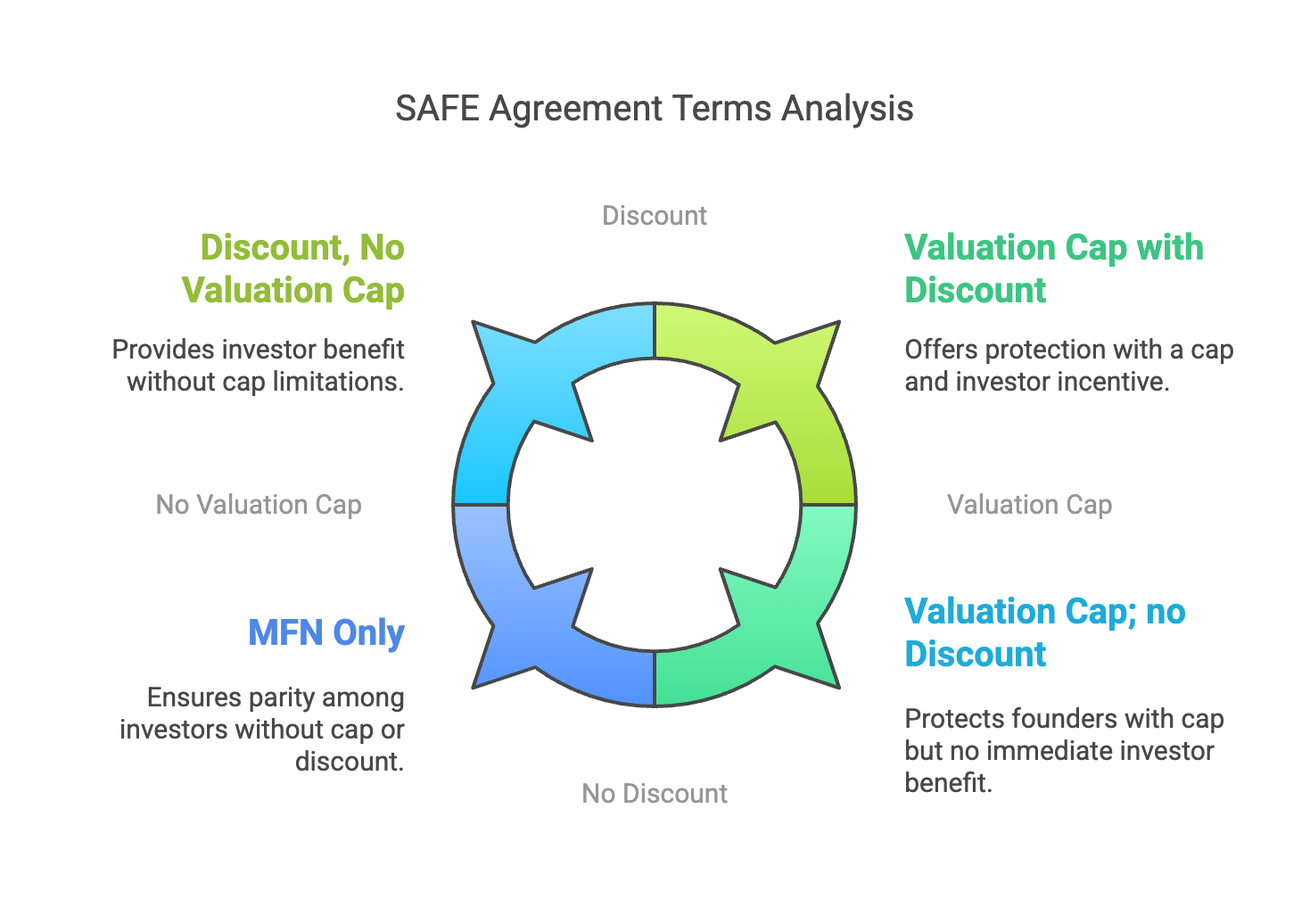

In such a scenario, Safe notes act as a convertible security note - a simple easy fast fundraising agreement that requires no pre or post-money valuation without maturity dates.

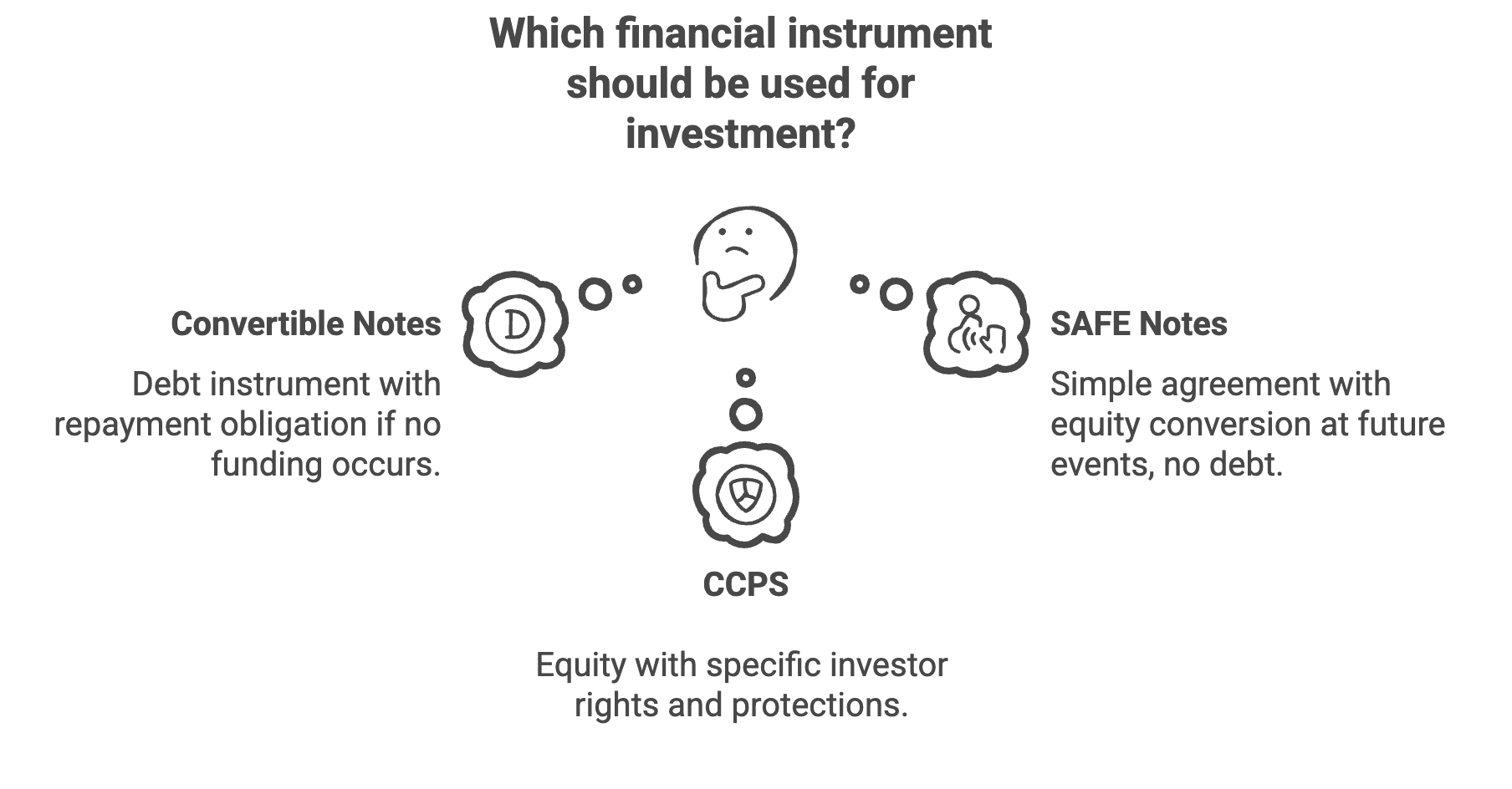

Convertible Notes is designed as debt instruments that convert into equity based on the conditions in the agreement. The start-up may be required to repay the amount in case of failure of the subsequent series funding.

Safe Notes are not debt instruments. It allows the investor to convert the safe notes into equity at a future funding round. SAFE notes are automatically convertible on the occurrence of specified liquidity events viz. next pricing/valuation round, dissolution, merger/acquisition, etc

CCPS is the shares with certain rights are allotted to the investor. Under the CCPS route - CCPS is issued to the investor on the following terms as agreed between the Company and the Investor:

On the other hand, under the SAFE note route- a simple agreement is entered with the investor to receive equity shares contingent upon certain events such as a subsequent round of funding. The company is not bound by the terms as usually agreed in the case of CCPS.

To comply with applicable Indian law, SAFE notes take the legal form of compulsorily convertible preference shares (CCPS) which are convertible on the occurrence of specified events. In India, iSAFE was pioneered by 100X.VC in July 2019. iSAFE stands for India Simple Agreement For Future Equity. Like an option or warrant, an iSAFE note allows the investor to buy shares in a future priced round.

Many start-ups issue iSAFE notes by entering into an iSAFE agreement with the investor. iSAFE notes carry a non-cumulative dividend @ 0.0001%.

In this article, we have explained the overview of SAFE notes, the advantages to start-ups, founders, and investors, the challenges they may face, and the precautions to be taken to mitigate the risks. Though SAFE Notes are simpler, easier, and cost-effective (in terms of legal fees) and don't have the same level of cumbersome rules that other types of securities have, it has their risks and challenges. The start-up needs to carefully evaluate the fundraising process as any wrong move can jeopardize the growth plans of the Company.

Therefore, it is advised that Companies consult legal advisers who have worked in start-ups and early stage businesses ecosystem and then decide on the ways of funding keeping in mind the legal compliances.

CONTACT

Email us or complete the form to learn how we can help you with our services.

vs@vandanasingh.in

For any inquiries or assistance, feel free to reach out to us.

We value your feedback! Share your thoughts and suggestions with us.